4 Things You Need to Know Before You Start Investing in Property

So, you are curious about investing in property, but you aren’t sure where to start? These are 4 key things you need to know before you begin.

1. What does investing in Property look like?

Investing in Property can take a number of different forms. The basic concept is that someone (the investor) purchases a property with the purpose of either renting it out and earning a return or selling it on for a profit.

Property investments are generally considered to be less risky than the stock market, and can ensure a steady income stream over time. Other, more risky, property investments are also available; these can sometimes offer higher returns, and often include a portion of the investment going towards renovating or developing properties that will sell for a great deal more than the principal investment.

2. Who can be a property investor?

One of the most common ways millions of people invest in property is through their own home – if you own a property and have witnessed its value appreciate over time, then you are a property investor. Your original investment when you purchased the house can result in a profit!

Many people who have ‘fixed-up’ their own home have also experienced investing in property; by spending an upfront amount (of time or money) on renovating a property, and earning a higher house value as a result.

3. How do I buy an investment Property?

If you are looking to invest in a property yourself, one of the key questions to consider is whether you would like to Buy to Let or Buy to Sell.

Buy to Let involves purchasing a property (sometimes outright, sometimes with a Buy to Let mortgage) and renting it out. The rental income can then be used for personal income, covering the mortgage payments for the property or for buying more property investments. Buy to Let is a common method of property investment and has the potential not only for stable returns (called rental yield), but also growth year-on-year.

Buy to sell is another investment strategy, where the investor purchases a property and renovates it; this is often called a property development. The aim is to increase the value of the property considerably, over the initial cost of the property and contractors, to maximise returns.

The two investment strategies each have their own benefits; Buy to Let is often preferred because it requires a less hands-on approach compared to Buy to Sell. For this reason, Buy to Sell investment opportunities are often available in the form of investing in a property development companies stock, or bonds which are raised by firms who want to develop property themselves.

There are also different legal implications between Buy to Let and Buy to Sell – renting out property to tenants is a very different from project managing a development, too! Ensure that you understand the differences between the two before you jump into either.

4. Where should I invest, geographically?

Another key property investment tip is researching the locations where good rental yields can be made. This can mean choosing an appropriate region in your country, but also prime areas for investment within individual cities and regions.

You can find the average rental yields for different regions online, but it can also be a good idea to visit or have an understanding of the area you plan to invest in. For example, you can understand whether you should be focusing on upmarket tenants or students.

Think about Scotland specifically Glasgow and Edinburgh, during the second quarter of 2020, average rents in Glasgow rose by 1.4% year-on-year to £810. Four bedroom properties experienced the greatest year-on-year increase in rents, rising by 3.1% to £1,858.

Average time to let in Glasgow was 38 days, nine days slower than last year. Four bedroom properties also boasted the shortest time to let at 32 days, five days slower than last year. 19% of Glasgow properties were let within a week while 49% were let within a month. According to Park Gate Investments the City is “a globally competitive standing in industry sectors such as Finance and Business, Digital Technology, Creative Industries and Engineering; it is easy to see why Glasgow is, has been, and continues to be an extremely popular location for investors and tenants alike”.

Finally, it is important to recognise that Buy to Let is often appropriate where property values are lower; by their nature, percentage yields available on these investments are often higher, and there are more opportunities for growth in the value of the property. Buy to Sell is often more appropriate in areas with higher property values, where run-down properties can be prime for renovation and re-selling!

Property Apps & Websites

As with everything these days there are a number of apps to help the seasoned professional or the property investment newbie.

Property Investor App

Provides exclusive access to a UK wide portfolio of property investment opportunities these deals are all pre-negotiated and ready to go packaged property investments.

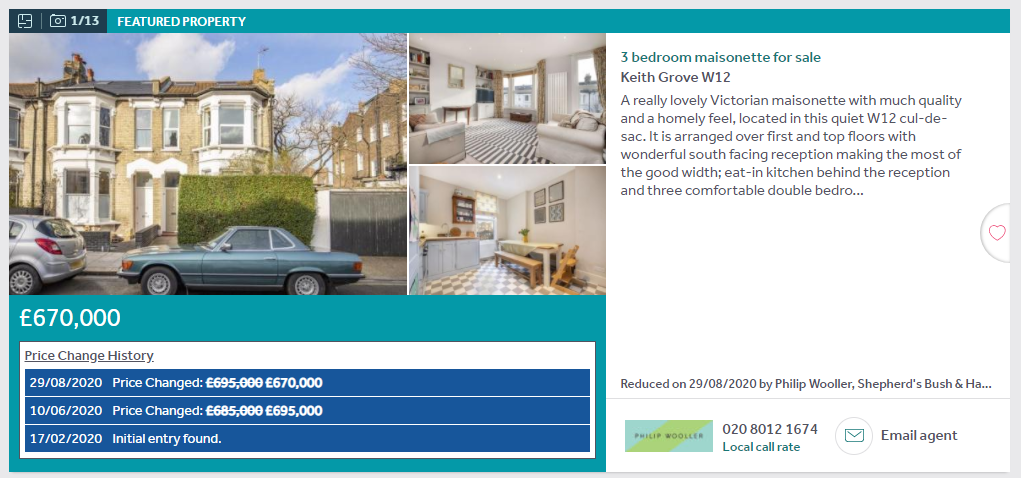

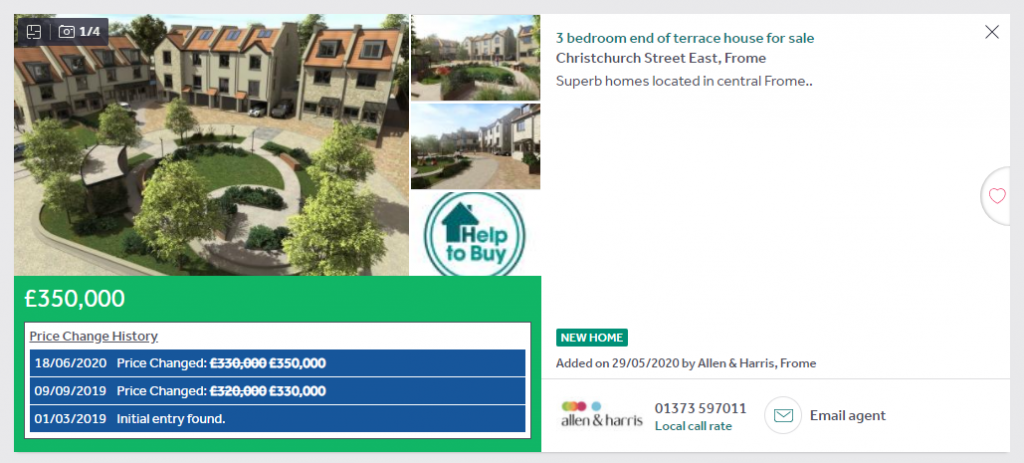

Property-Bee

This is a really simple, yet extremely powerful little tool that will give you a wealth of extra data about properties as you browse them on Rightmove.

It’s free to use, you just install the plugin and, when you next view a property on Rightmove, you’ll see extra details added to the listing. This includes things such as whether the property has been reduced in price and when, if anything has changed on the description, if it has been listed on the market previously, and so on. Interestingly you can also see when a price has been increased!

You can then use this information to help you negotiate a lower price on a property as you’ll know if the owners are struggling to sell at the current price

Proptee

We’ve already written about this great app. Ideal for the armchair investor who wants a hands off approach. Read the article here

Sprift

Sprift is a data aggregator software, is to collects a wide range of information about any given property and collates it all in one easy-to-use platform. That makes it perfect when performing research on potential properties to buy.

You can also manage the properties you already own and the documents related to them within the tool, too. There’s even a number of handy calculators so you can calculate build costs, yields, and financing.

It has a number of pricing plans for regular investors or a pay as you go option from just £10 per report.

Responses